Working capital funding for small businesses is affected by several factors that influence pricing and approval rates. Here’s how credit, time in business, industry, and cash flow impact working capital funding, and why it’s generally easier to get approved for than SBA or traditional bank loans:

Cash Flow Considerations

Your business cash flow is the most important factor in working capital funding:

Lenders offer 30% – 120% of what your business averages in gross monthly deposits as a max funding amount

Minimum of $15,000 gross monthly deposit average required to qualify

Strong, consistent cash flow may lead to better rates and terms

Seasonal fluctuations in cash flow are taken into account

Credit Score Impact

Your credit score plays a role in determining the cost of working capital funding but is not a deal breaker.

Better credit scores may lead to lower interest rates

Even businesses with less-than-perfect credit can often qualify (Min of 500 required)

Time in Business

The length of time your business has been operating affects your funding options:

Newer businesses may face higher costs due to perceived risk

Established businesses with a longer track record may get better rates

Most lenders require at least 3 months to 1 year in business, which is less than traditional banks

Industry Factors

Your business industry can impact working capital funding terms:

Some industries are seen as riskier and may face higher costs

Seasonal businesses may have different funding needs and terms

Lenders may specialize in certain industries, offering better rates

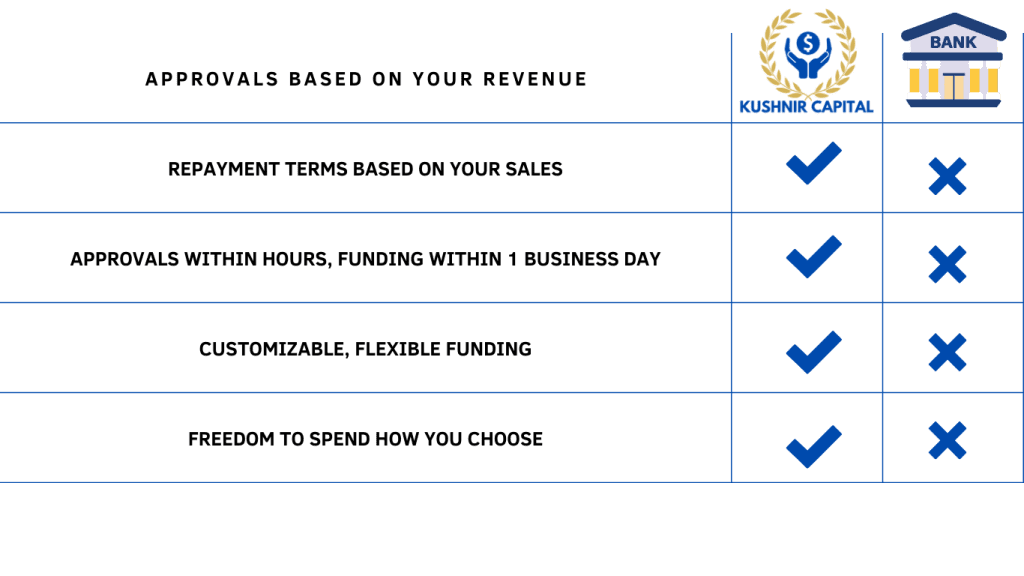

Easier Approval Process

Working capital funding is generally easier to get approved for than SBA or traditional bank loans:

Less stringent credit requirements

Faster application and approval process

Focus on recent business performance rather than long-term history

Less paperwork and documentation required

More flexible use of funds

Working capital funding offers a more accessible option for small businesses needing quick access to funds. While factors like credit, time in business, industry, and cash flow affect pricing, the overall process is more relaxed and accommodating compared to traditional lending options

Our team has helped secure over $30M in funding for business owners across the US.

We streamline the funding process for you- using our knowledge, network, and experience to get your business the best deal possible.

We know that time is of the essence when it comes to funding. That's why we have a streamlined application & offer fast approvals to ensure your business has the cash it needs when it needs it.

Get approved for up to 100% of what your business averages in gross monthly deposits as a maximum funding amount. No collateral required and the debt is private & does not report to credit bureaus.

Rates & Terms are based on the overall risk assessment of your business. If you have a bankable business, the benefit of working with Kushnir Capital is flexibility & privacy. Terms offered ranging from 3 to 24 months

Our team has 12+ years industry experience providing working capital to businesses just like yours. We are dedicated to presenting options that are in your best interest with a network of lenders you can trust.