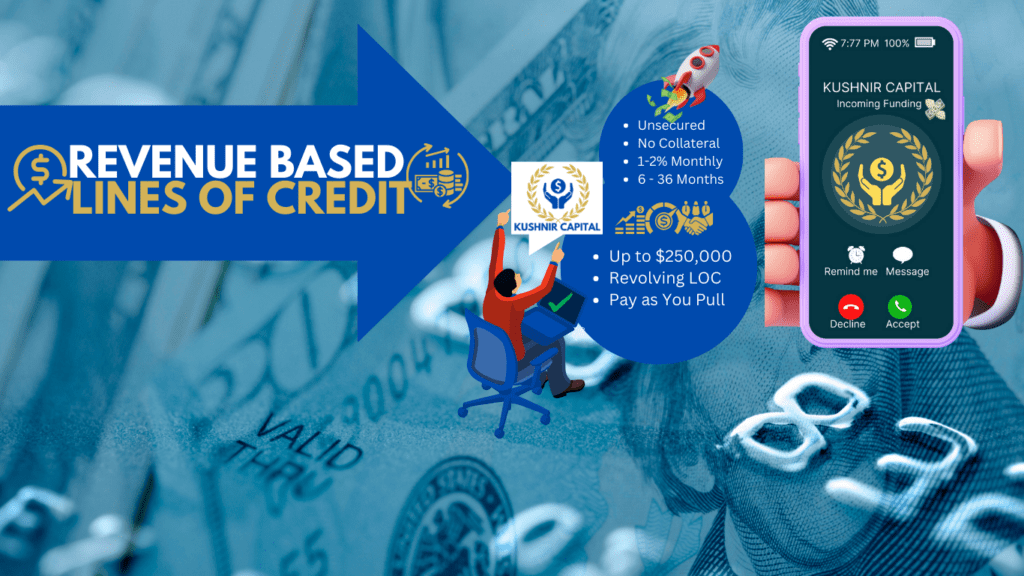

At Kushnir Capital, we specialize in providing flexible and accessible financing solutions for small businesses. Our expertise lies in offering unsecured lines of credit tailored to meet the unique needs of entrepreneurs and business owners like you. We understand that small businesses require financial agility to thrive in today’s dynamic market. That’s why we offer unsecured lines of credit with the following features:

While our approval process is more streamlined than traditional banks or the SBA, we still conduct a thorough assessment to ensure we match you with the best financing option. Our evaluation considers:

This approach allows us to offer competitive rates while maintaining responsible lending practices.

Our unsecured line of credit provides you with a revolving fund that you can tap into as needed. This flexibility allows you to:

Unlike traditional loans, you only pay interest on the amount you draw from your line of credit. This means:

We offer weekly or monthly repayment schedules, allowing you to choose the option that best aligns with your business’s cash flow patterns.

We partner with a diverse network of lenders, each specializing in different industries and risk profiles. Our expert team will:

At Kushnir Capital, we’re committed to empowering small businesses with the financial tools they need to succeed. Let us help you unlock your business’s potential with our flexible unsecured line of credit solutions.